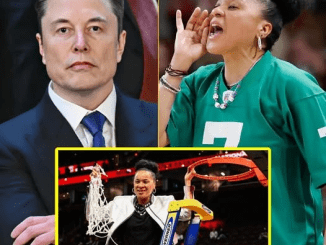

“We have to act now, or the United States will actually go bankrupt,” Musk said in comments to financial and prediction market Kalshi about the national debt, according to the Tass news agency.

As the richest man in the United States and the world, Musk has been vocal about the country’s financial future. In a recent interview on The Joe Rogan Experience podcast, he warned: “The country is on the verge of bankruptcy. If we don’t act, the dollar will be worthless.”

Musk’s main concerns revolve around the US’s massive national debt, which has now reached $36.17 trillion. Managing the debt is becoming increasingly difficult and expensive, with interest payments taking up a large portion of the government’s budget.

“Twenty-three percent of the US government’s revenue is used to pay interest on its debt, and that number keeps growing,” Musk said. So if we don’t do something, the entire government budget will just be enough to pay interest, with no money left for other activities like Social Security or Medicare. That’s what bankruptcy means.”

The numbers paint a grim picture. Specifically, in fiscal year 2024, the US will have to pay up to $1.1265 trillion in interest, while the budget will only reach $4.92 trillion. Mr. Musk said that the situation is very serious and that if there is no remedy, the US economy will be destroyed.

“I look at these numbers and I think if we don’t do something, America will be destroyed,” Mr. Musk emphasized the urgency of the situation.

However, whether the US can technically go bankrupt is a complicated question. The US government cannot file for bankruptcy like a business, but it is up to Congress to decide whether to default on debt or continue borrowing. Another concern is that the government could print more money, driving down the value of the dollar, which could have consequences as dire as a bankruptcy.

“Technically, the government can’t go bankrupt because they only promise to provide a certain number of dollars. They don’t promise the value of those dollars. That means the government could print so much money that the dollar is virtually worthless. To us, that would be the same as if the government went bankrupt,” said the co-host of the Words & Numbers podcast.

While the situation has many worried, experts from JP Morgan believe that the possibility of a US default is still “very low”. The reason is that the US still has the unique advantage of issuing debt in the US dollar – the global reserve currency – and a strong tax system that can help increase revenue through tax reform if needed.

Whether the situation is as dire as Mr. Musk warns remains to be seen. While the situation is still unclear, there is still confidence in the recovery. In the past, investors have found ways to protect themselves from the impact of inflation. Mr. Musk shared this strategy in 2022: “When inflation is high, it is better to own tangible assets such as real estate or stocks of manufacturing companies, rather than holding cash”.

When inflation increases, real estate values tend to increase, due to rising costs of materials, labor and land. Additionally, rental income from real estate typically increases, providing a steady and inflation-adjusted income stream. This combination makes real estate an attractive option for protecting and growing wealth, especially as the value of the US dollar declines.