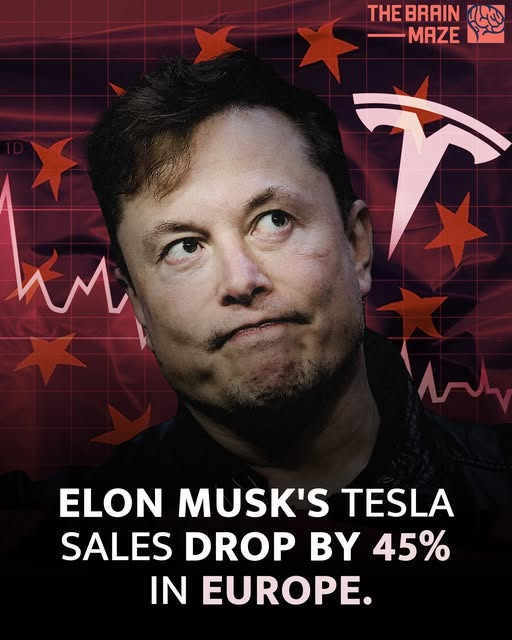

January 2025 proved to be a tough month for Tesla, as the electric vehicle giant reported a 45% drop in sales, selling just 9,945 units. This significant decline has put additional pressure on Tesla’s stock, which has already fallen 23% this month.

Global Struggles and Weakening Demand

Tesla’s challenges aren’t limited to the U.S. market. Global demand for EVs has softened, forcing the company to increase price cuts to attract buyers. Despite aggressive strategies, concerns about market saturation, rising competition, and economic uncertainty have dampened consumer enthusiasm.

Cybertruck Discounts and Tax Credit Challenges

In an effort to revive sales, Tesla recently slashed the price of the Cybertruck by up to $6,000. However, the vehicle’s ineligibility for federal EV tax credits has added to concerns about unsold inventory and declining consumer interest. The Cybertruck, once a highly anticipated model, now faces questions about its market viability.

Investor Concerns and Stock Pressure

With sales dropping and Tesla’s stock already taking a hit, investors are closely watching the company’s next moves. CEO Elon Musk has hinted at potential new models and innovations, but whether these will be enough to reverse the downturn remains uncertain.

As competition in the EV industry intensifies, Tesla faces a critical moment in maintaining its dominance. The coming months will be key in determining if the company can regain momentum or if it will continue to struggle in an increasingly challenging market.