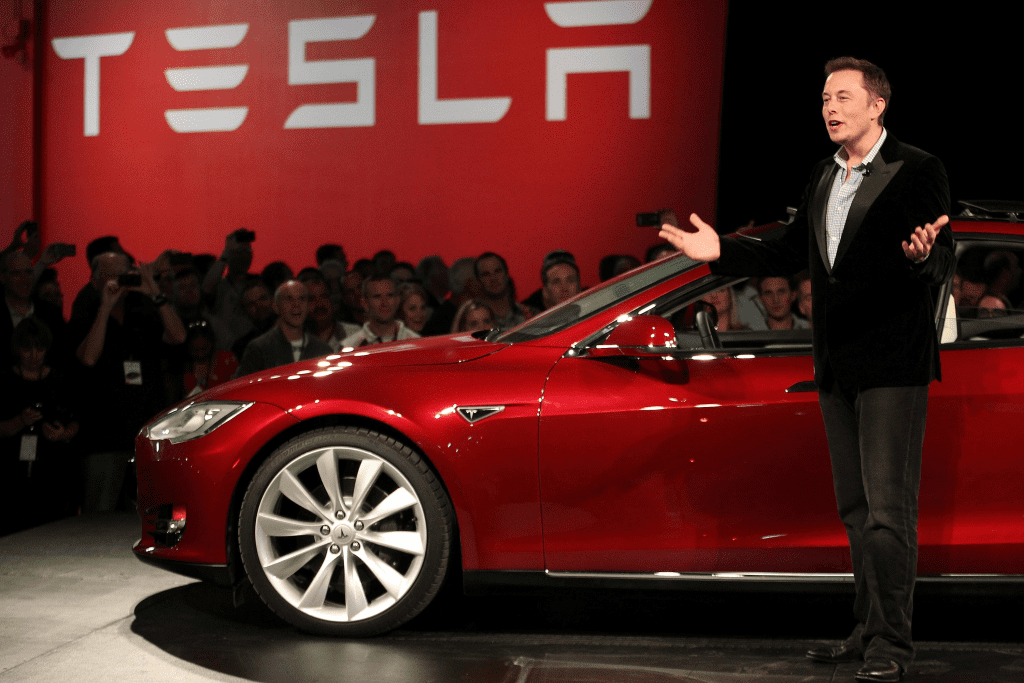

In a twist of fate that feels almost poetic, the very company Elon Musk once dismissed has emerged as one of Tesla’s most formidable rivals in the electric vehicle (EV) industry. For years, Musk was celebrated as the driving force behind the EV revolution, with Tesla becoming synonymous with cutting-edge technology, sleek designs, and sustainability. However, a challenger from China—BYD—has rapidly ascended the global ranks, transforming from an underestimated underdog into a powerful contender capable of reshaping the future of the automotive industry.

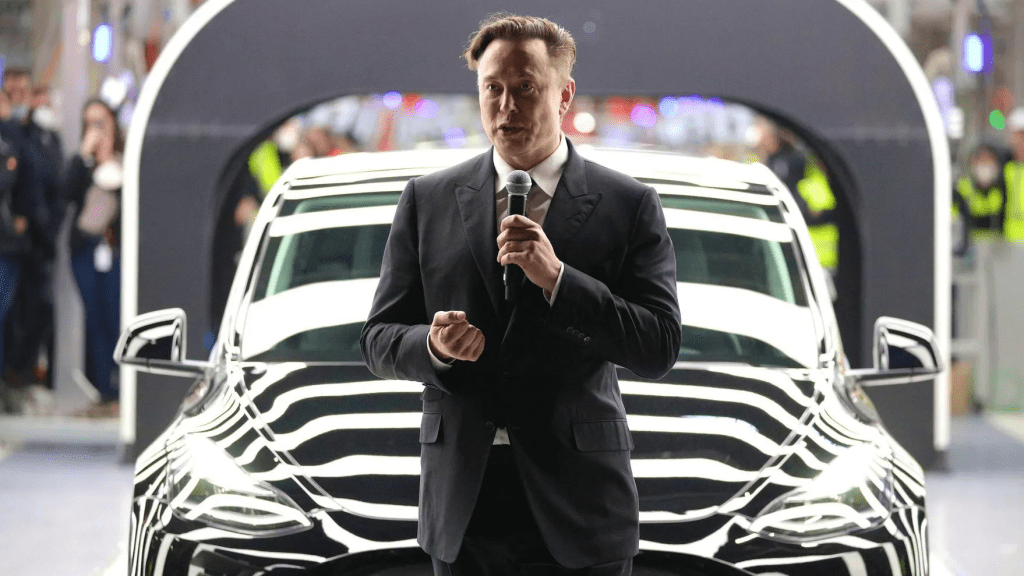

Back in 2011, during a Bloomberg interview, Musk scoffed at BYD, responding to a question about the company with a dismissive, “Have you seen their car?” His remark reflected a mixture of disdain and underestimation. Fast forward more than a decade, and BYD’s meteoric rise has made that statement seem quaint in hindsight.

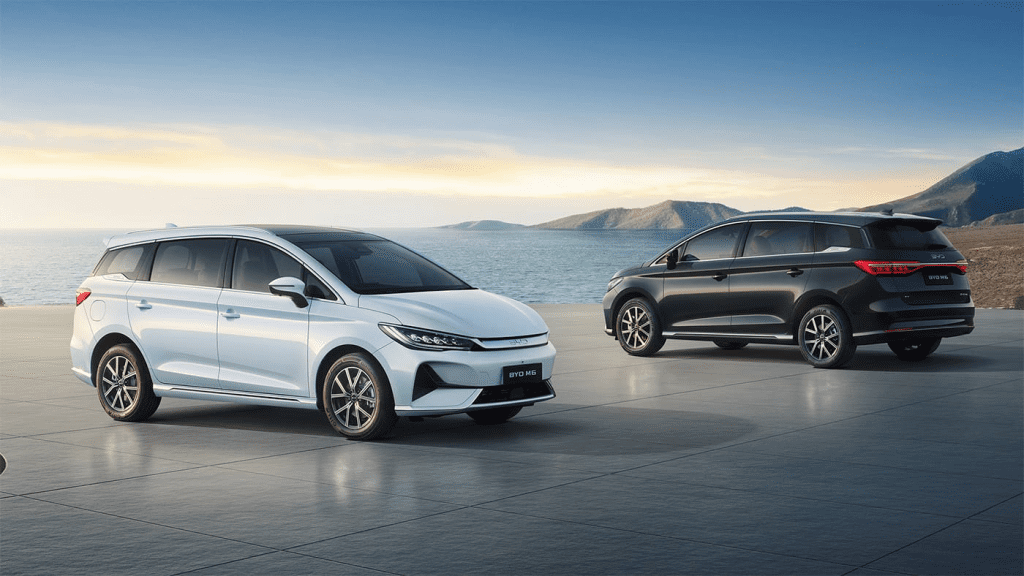

While Tesla remains dominant in the United States—thanks in part to tariffs protecting domestic manufacturing—BYD has expanded aggressively in China, the world’s largest auto market. The company’s growth has been staggering. In 2024, BYD reached a monumental revenue milestone of $107 billion, surpassing Tesla’s annual earnings by approximately $10 billion.

To make matters worse for Tesla, BYD recently unveiled a new charging system capable of providing 250 miles of range in just five minutes, a major leap in EV technology. This innovation highlights BYD’s capabilities not only in vehicle production but also in advancing charging infrastructure—an area where Tesla once held a commanding lead.

Meanwhile, Tesla investors have been retreating, with the company’s stock experiencing a nine-week consecutive decline. Although market fluctuations are normal, Tesla’s stock struggles signal deeper concerns. Global sales dipped for the first time in Tesla’s history last year, and signs of improvement remain elusive. One of Tesla’s most pressing challenges is its waning market share, particularly in China. Its core vehicle models, which once defined EV innovation, have not seen significant updates in years. The long-promised low-cost Tesla model has yet to materialize, allowing competitors to erode Tesla’s once-unassailable lead.

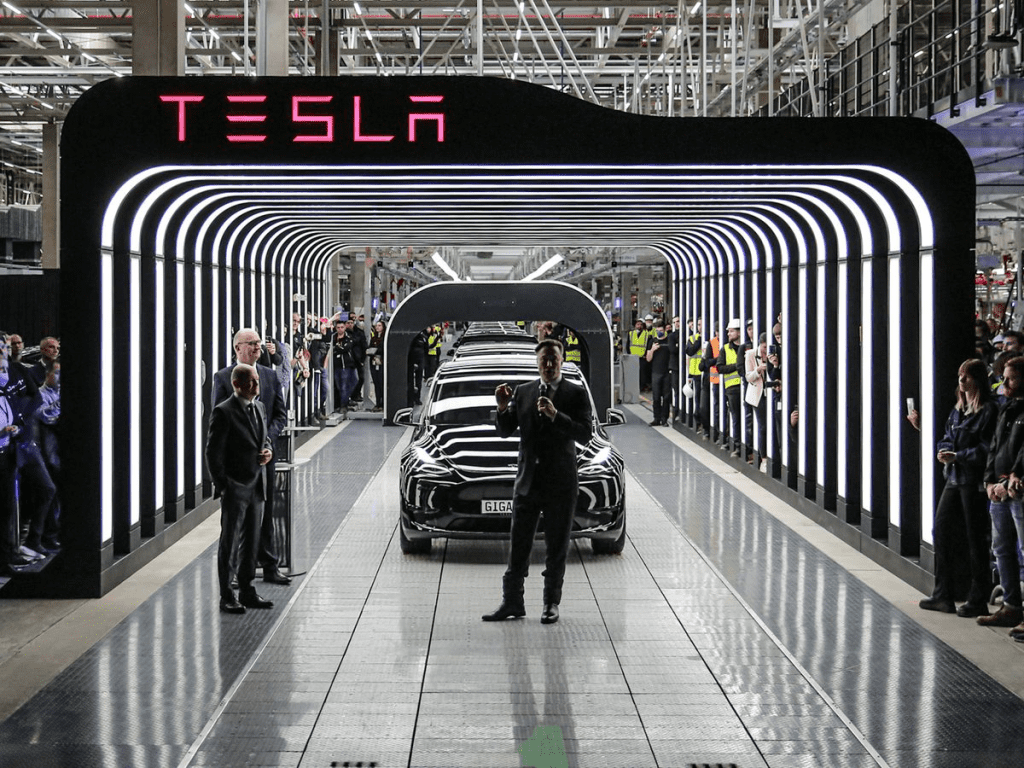

Tesla’s struggles extend beyond innovation. The company has also faced backlash due to Musk’s polarizing political affiliations. Once a favorite among environmentally conscious liberals, Tesla has, in recent years, become increasingly associated with conservative and far-right political movements, alienating segments of its original customer base. This shift has had tangible consequences: in Europe, Tesla’s sales plunged by 44%, while Chinese brands surged by 82%, according to JATO. In Germany, Tesla saw a dramatic 75% drop in sales, reflecting a backlash against Musk’s perceived alignment with extremist political groups.

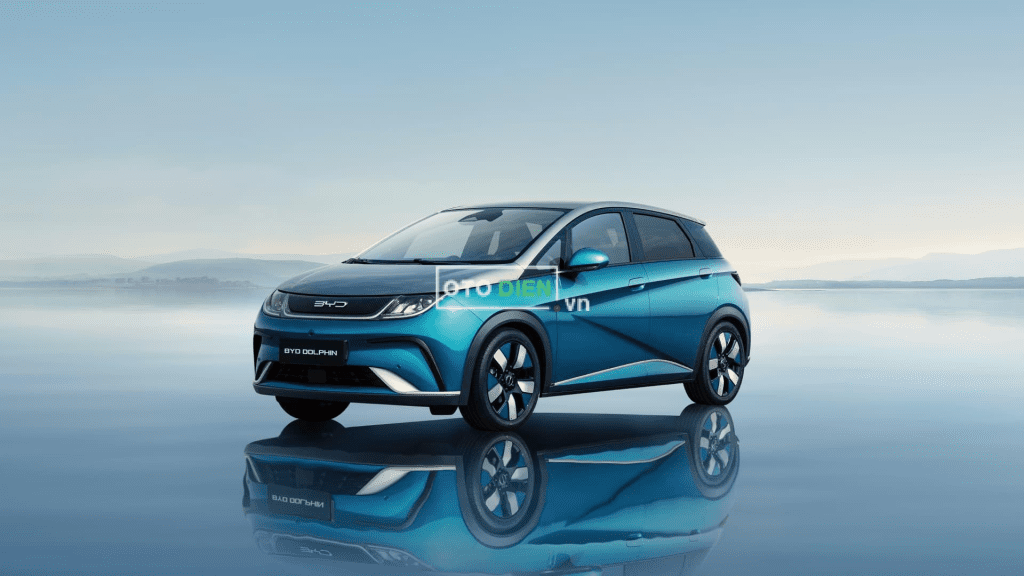

As Tesla grapples with these challenges, BYD continues to surge forward. The Chinese automaker has mastered the art of producing high-tech EVs and plug-in hybrids at a fraction of Tesla’s costs. For instance, BYD’s entry-level EVs start at under $10,000 in China—far below the Tesla Model 3’s $32,000 starting price. Even the new BYD Qin L EV, which rivals the Model 3 in specifications, costs only $16,500 while boasting a range of over 330 miles and advanced smart driving features.

BYD’s ability to combine affordability with innovation has enabled it to dominate mass-market EV sales in China and expand globally. Tesla, in contrast, has struggled to compete in emerging markets, where affordability plays a crucial role in consumer decisions. This misalignment has left Tesla vulnerable to rising competition from companies like BYD, whose success has largely been fueled by its ability to cater to a broader audience.

In response to mounting pressure, Tesla has been developing a smaller, more affordable Model Y variant. However, production is not expected to begin until 2026, which may be too late. By then, BYD could solidify its position as the global EV leader, leaving Tesla playing catch-up.

Despite its challenges, Tesla remains a powerful force in the EV market, particularly in the United States, where tariffs and trade barriers offer a buffer against foreign competition. However, without these protections, BYD could become Musk’s worst nightmare.

The rise of BYD serves as a cautionary tale for Tesla. Musk’s initial dismissal of the Chinese automaker has transformed into a lesson in the dangers of underestimating competitors. While Tesla remains a strong player, its shrinking market share, aging product lineup, and political controversies have placed it in a vulnerable position. Meanwhile, BYD continues to innovate and offer affordable, high-tech EVs, posing a serious challenge to Tesla’s dominance. If Tesla does not adapt quickly, it risks being overtaken by the very company Musk once dismissed as irrelevant.