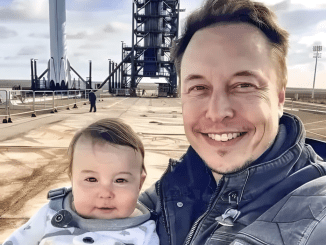

Elon Musk’s $450 Million Charity Faces Scrutiny: Is Its Tax-Exempt Status at Risk?

Elon Musk’s philanthropic reputation is under intense scrutiny as the IRS steps in to review the operations of his $450 million charity. The Musk Foundation, established with the goal of addressing issues like sustainable energy, education, and global health, now faces the very real threat of losing its tax-exempt status—a blow that could shake not only the foundation’s credibility but Musk’s public image as a philanthropist.

With tax regulations becoming increasingly stringent, the billionaire inventor must prove that his charity is compliant with the necessary legal requirements—or risk facing major consequences. Let’s break down what this scrutiny means, how the IRS is involved, and whether Musk’s charity can navigate the legal hurdles ahead.

📉 The IRS’s Involvement: Why is the Charity Under Scrutiny?

The Internal Revenue Service (IRS) has launched an investigation into the Musk Foundation due to concerns about how it has been operating, particularly in regards to its funding distribution and how the money is being allocated. As a tax-exempt organization, the Musk Foundation is supposed to focus on public benefit and meet specific regulatory requirements that govern how much it must contribute to charitable efforts.

Recent reports suggest that the charity hasn’t distributed the minimum percentage of its assets as required by law, causing alarm among tax experts. Private foundations are mandated to spend at least 5% of their assets annually on grants and charitable programs. For a foundation like Musk’s, with hundreds of millions in assets, that 5% translates to tens of millions of dollars each year. However, there are reports indicating that the foundation has fallen short in its distribution efforts, which could jeopardize its nonprofit status.

According to nonprofit legal expert Sylvia Roberts:

“When a foundation operates on the scale of Musk’s, they’re expected to adhere to the law, including meeting the minimum payout requirement. If they don’t, the IRS can revoke their tax-exempt status, and this could have major ramifications not just for the charity, but for Musk’s entire philanthropic strategy.”

💰 The Financial and Legal Consequences

If the IRS does find that the Musk Foundation has been non-compliant with its obligations, the consequences could be severe. Losing tax-exempt status would mean that the foundation would no longer be able to receive donations that are tax-deductible, which could severely impact future fundraising efforts.

Additionally, the IRS could impose hefty fines or penalties on the foundation, and the public backlash from Musk’s supporters could further tarnish his philanthropic efforts. For a billionaire whose public persona is linked to solving major global issues, the loss of his charity’s tax-exempt status would signal a significant setback.

A former IRS agent, Mark Daniels, shared his concerns:

“If this foundation is found to be failing in its legal duties, it would represent a massive credibility issue for Musk. Philanthropy is a major part of his public image, and this investigation will be closely watched by the media and his critics.”

🔍 Can Musk Defend His Charity?

Musk’s response to the IRS’s investigation will be crucial in determining whether the foundation can retain its tax-exempt status. Given Musk’s history of taking bold, unorthodox approaches, he could argue that the foundation’s strategy focuses on long-term projects that require large capital investments, rather than short-term distributions. He might also point to some of the successful programs funded by the charity, like Starlink’s disaster relief initiatives or investments in sustainable energy research.

However, with such a large public profile and legal spotlight on the foundation, Musk’s typical defiance could backfire. Transparency and documentation of the charity’s spending could be key in proving that the foundation is operating within the bounds of the law.

Musk has not made an official statement yet, but sources close to the billionaire say that he is working with legal teams to review all the financial records and respond appropriately to the IRS’s concerns.

🌍 The Bigger Picture: Musk’s Philanthropic Legacy

This situation raises larger questions about the future of philanthropy in the age of billionaires. As Musk continues to push boundaries in technology, space exploration, and energy, many have lauded his ability to take risks and innovate. However, when it comes to philanthropy, the standards are different—and for good reason.

Philanthropy is not just about throwing money at global challenges. Nonprofits are held to strict standards, and the transparency of how funds are spent is paramount. Musk’s foundation could face greater public scrutiny if it’s not able to demonstrate clear and effective charitable contributions, especially when operating at the scale it currently does.

As Musk continues his work with Tesla, SpaceX, Neuralink, and other ventures, his foundation may be forced to adapt, restructuring in a way that allows it to meet these legal and public expectations.

💥 Will Musk’s Charity Survive?

For now, the IRS investigation continues, and the fate of the Musk Foundation hangs in the balance. With Musk’s reputation for ambitious projects and his ability to innovate, it remains to be seen whether this charity scandal will derail his legacy—or if he will rise to the challenge and meet the demands of transparency and legal compliance.

As the investigation unfolds, eyes will be on Musk, waiting to see whether his foundation can overcome this hurdle and continue to play a key role in his broader philanthropic goals. Will Musk’s charity emerge unscathed, or will it be forced to adjust its operations in order to stay afloat?