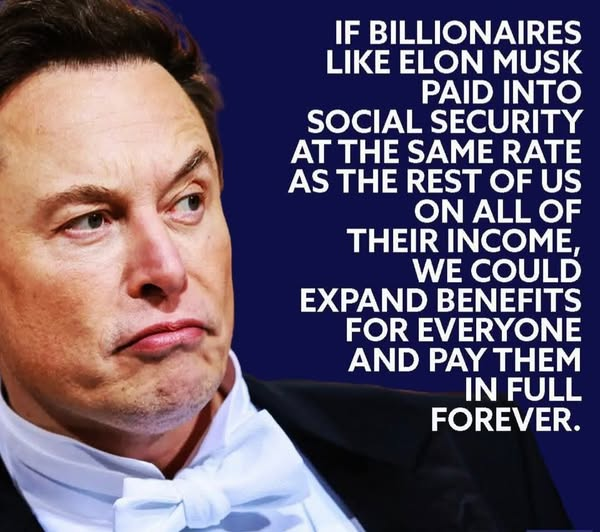

The debate over wealth inequality and tax contributions has been reignited by calls for billionaires like Elon Musk to pay into Social Security at the same rate as the average American worker. Advocates argue that if the ultra-wealthy contributed on all of their income, it could expand benefits for millions and sustain the system indefinitely.

The Current Social Security Tax System

Right now, only income up to $168,600 (as of 2024) is subject to Social Security taxes. This means that high earners, including billionaires, effectively pay a much smaller percentage of their total income into the system than middle- and lower-income workers. Critics say this cap disproportionately burdens everyday employees while allowing the wealthiest to contribute only a fraction of their earnings.

Could Billionaire Contributions Fix Social Security?

Proponents argue that if billionaires paid Social Security taxes on all of their earnings, it could:

✅ Extend Social Security’s solvency indefinitely

✅ Increase monthly benefits for retirees

✅ Provide greater financial security for future generations

However, opponents believe such a change could discourage investment and job creation, and that the government should focus on reducing waste and reforming entitlement programs instead.

Elon Musk’s Perspective on Taxes

Elon Musk has previously criticized high tax rates, arguing that the government often mismanages funds. In 2021, he stated that he paid over $11 billion in taxes, one of the largest tax payments in U.S. history. Musk and other billionaires believe that instead of higher taxes, the focus should be on economic growth and innovation.

The Road Ahead

With Social Security facing financial challenges, the question remains: Should billionaires pay more to sustain the program, or is there a better solution? The debate continues, but one thing is certain—the future of Social Security will impact millions of Americans for generations to come.