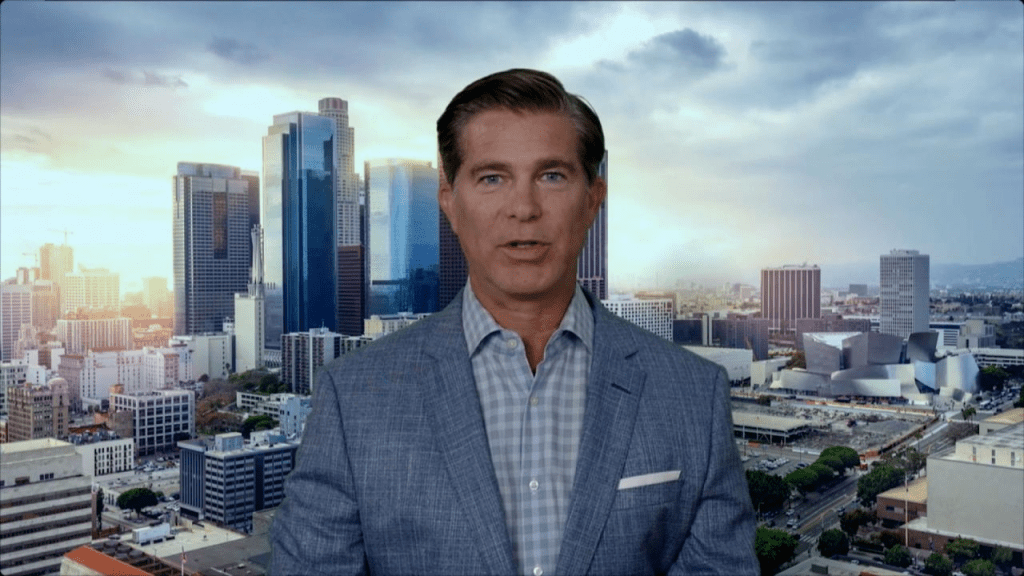

Tesla Investor Ross Gerber Urges Elon Musk to Resign Following $800 Billion Drop in Stock Value

In a stunning turn of events, Ross Gerber, one of Tesla’s largest and most influential investors, has called for Elon Musk to step down as CEO following an unprecedented stock plunge. Tesla’s market value has cratered by a staggering $800 billion, a loss that has left investors, industry analysts, and the public questioning the future of the electric car giant.

Gerber’s call for Musk’s departure highlights growing concerns over the company’s direction under Musk’s leadership, as well as broader market implications of the CEO’s political and business decisions.

Tesla’s stock, once a darling of Wall Street and the most valuable automaker in the world, has seen a sharp decline in recent months. In a series of unfortunate events, Tesla’s valuation has plummeted by a jaw-dropping $800 billion.

This dramatic fall, which occurred over a matter of months, reflects both the fragility of the electric vehicle (EV) sector and the deepening concerns over Tesla’s leadership under Musk.

While Tesla’s stock has always been subject to volatility due to its speculative nature, the latest decline is being attributed to a range of factors — some of which are deeply tied to Musk’s personal and business decisions. From controversial political stances to strategic shifts in company focus, the erosion of investor confidence in Musk’s ability to steer Tesla toward sustainable growth is now undeniable.

Tesla’s recent struggles can be traced back to Elon Musk’s increasing involvement in politics, particularly his vocal support for former U.S. President Donald Trump. Musk’s alignment with Trump’s policies and public endorsements alienated many of Tesla’s key supporters, especially in environmentally-conscious and progressive circles. This divergence from Tesla’s core audience led to growing discontent among consumers and investors who viewed Musk’s political stance as conflicting with the company’s green mission.

Musk’s political engagement extended beyond endorsements. He joined Trump’s advisory council during his presidency and later became an outspoken critic of government regulations and taxation policies. While this appealed to certain segments of his base, it also sparked significant backlash. Protests and boycotts emerged, with activists accusing Musk of prioritizing his personal political agenda over Tesla’s sustainability goals. Demonstrators gathered outside Tesla showrooms across the U.S. and Europe, demanding that Musk step down in favor of a more socially responsible leader.

This public and investor dissatisfaction contributed to the erosion of Tesla’s reputation and a steep decline in its stock price. Adding to the turmoil was Musk’s growing obsession with cryptocurrency, particularly Dogecoin. His frequent social media endorsements led to sharp fluctuations in Dogecoin’s value but also raised concerns about his commitment to Tesla. Critics questioned whether Musk was devoting enough attention to Tesla’s core business as he increasingly focused on crypto-related ventures.

Within Tesla, frustration mounted among executives and engineers who felt the company needed Musk’s leadership to remain competitive. Despite strong demand for electric vehicles, Tesla’s rivals—such as Rivian, Lucid Motors, and legacy automakers investing in EV technology—continued to gain ground while Tesla appeared distracted. The company’s inability to address these competitive challenges further eroded consumer confidence, exacerbating the decline in stock value.

Another significant factor in Tesla’s downturn has been Musk’s reduced involvement in its daily operations. With his attention divided among SpaceX, Neuralink, political advocacy, and social media controversies, Tesla’s leadership suffered from a lack of direction. Delays in product releases and an unclear strategic vision led to a slowdown in innovation, leaving investors and employees uncertain about the company’s future.

This uncertainty fueled internal unrest, with some key executives reportedly considering leaving Tesla. The instability within the company only deepened investor fears, accelerating the stock’s downward trajectory. Prominent Tesla shareholder Ross Gerber publicly called for Musk to step down, emphasizing the need for a CEO solely focused on Tesla’s long-term strategy. Gerber’s statement resonated with many in the financial community, sparking debates over whether Musk remains the right leader for Tesla.

While some argue that Musk’s visionary leadership is irreplaceable, others believe that Tesla’s future depends on new leadership that can restore stability and refocus on the company’s core mission. As Tesla faces increasing pressure from investors, employees, and competitors, it stands at a crossroads. The coming months will be crucial in determining whether Musk can regain Tesla’s momentum or if a leadership change is necessary to secure the company’s position as a dominant force in the EV market. Regardless of the outcome, one thing is certain—Tesla’s future hangs in the balance.